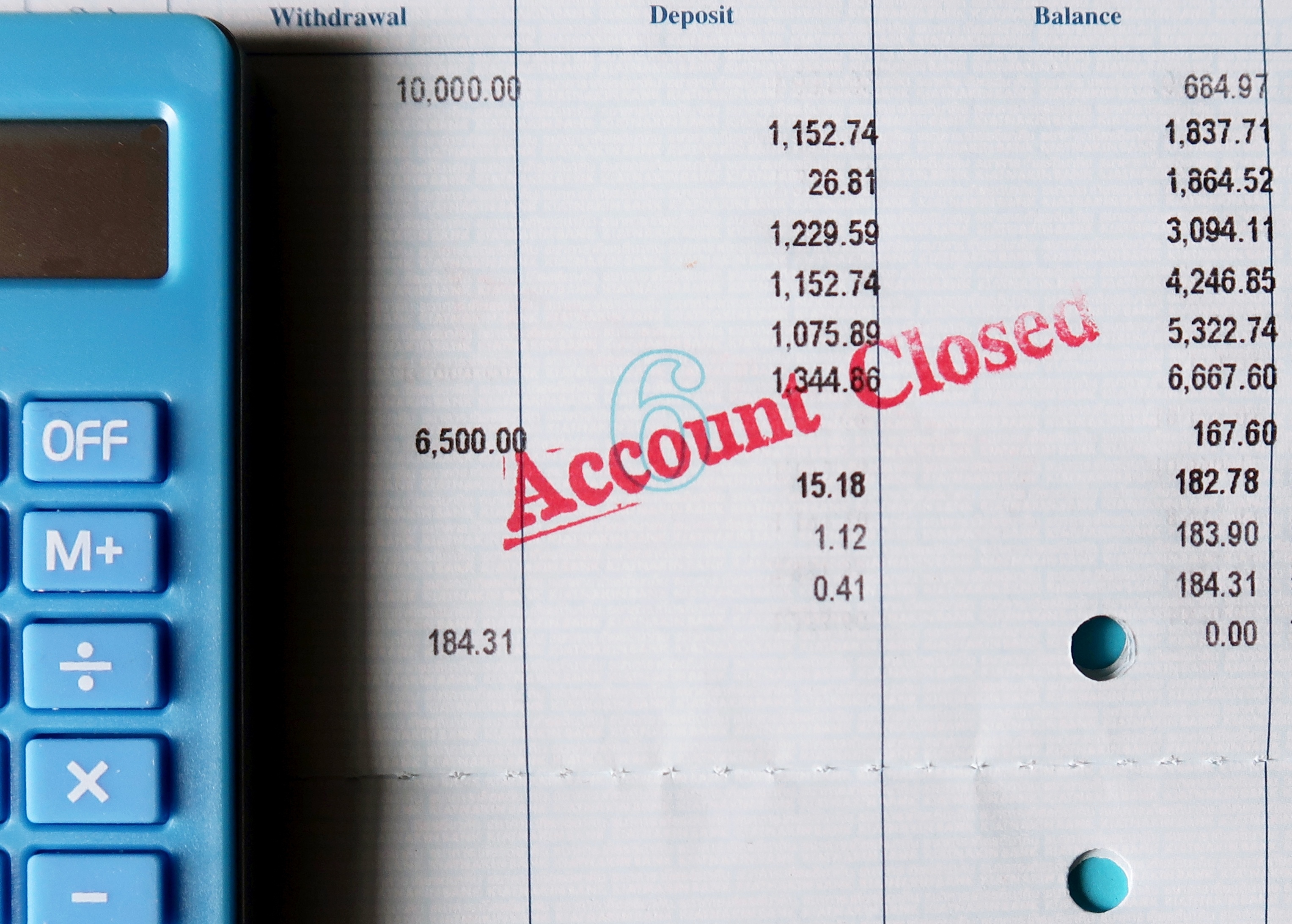

How Can I Get a Checking Account If My Previous Account Was Closed?

There are many reasons why a checking or savings account may be closed. Certain frowned-upon behaviors can result in a bank or credit union choosing to close a customer’s account. These types of actions can follow customers to different banks via a bank history report, similar to the way a credit rating is attached to every borrower.

All banks and credit unions report potentially problematic banking activities to third-party companies. Financial institutions request a report from these companies when new customers seek to open an account. Banks and credit unions may deny or limit new checking or savings accounts to people who pose a high risk.

Some examples of behaviors that may be flagged by these companies include:

- Having unpaid negative balances

- Frequent overdrafts

- Suspected fraud or attempted fraudulent activities

- A high rate of overdrafts or non-sufficient fund (NSF) transactions

- Bouncing checks frequently

Some of those warning signs can happen accidentally or are a rare occurrence for some banking customers. A handful of infractions over your entire banking life may not prevent you from reopening an account at the same credit union or bank or at a different financial institution, but having a long history of that type of behavior may make opening an account more difficult.

Legitimate Reasons an Account May Be Closed

There are also many benign reasons a credit union or bank may close out a checking or savings account.

These types of account closures typically won’t reflect poorly on your checking account history:

Account inactivity: You simply haven’t used the account in years (or sometimes months, depending on the institution) and the account is deemed to be inactive or dormant.

Low or zero balance: Although reaching a $0 balance may not automatically result in account closure, an inactive account or one that’s had the $0 balance for an extended period of time may be automatically closed.

Failing to meet minimum balance requirements:Some accounts do require a minimum balance. In some scenarios, especially for free checking or savings accounts, you may simply be charged monthly fees for going below the minimum balance. If you go below the minimum balance and there’s not enough money in the account to cover the fees, the account may be closed.

Account terms change or the account type is no longer offered: The terms and conditions by which you qualified for the account may change, or the bank may discontinue that type of account. You may decide you don’t like the new terms on the account they transitioned you to or don’t agree to the conditions, in which case the account may be automatically closed.

How to Get a New Account Opened

The steps you’ll need to take to get a new account opened will depend on why the account was closed. If your account was closed because you violated policies or rules, you may be restricted from opening some or all types of accounts at a bank. Alternatively, you may still be eligible to open a second chance account at credit unions or banks that offer them, like the Rise Checking account at OnPath Federal Credit Union. Eligibility for the account is dependent on management review and approval.

If your account was closed due to inactivity or another reason that wasn’t the result of bad behavior, you should be able to open a new checking account via the normal process.

What Are Second Chance Checking Accounts?

Second chance accounts typically have added restrictions or fees, like:

- Unwaivable monthly fees with no free checking options

- Inability to overdraft or overdraw

- Limits on debit card purchases

- No check-writing privileges

- Some banks or credit unions may mandate a specific type of financial education as part of the account opening process

The Rise Checking account offered by OnPath FCU offers some convenient perks you might not find with second chance accounts offered by other banks. For example, you can qualify for Courtesy Pay (similar to overdraft protection) if you remain in good standing. You also get a debit card and have access to mobile and online banking services.

If you’re looking for a new credit union that offers customer-centric service designed to make banking accessible and easy, consider becoming a membe